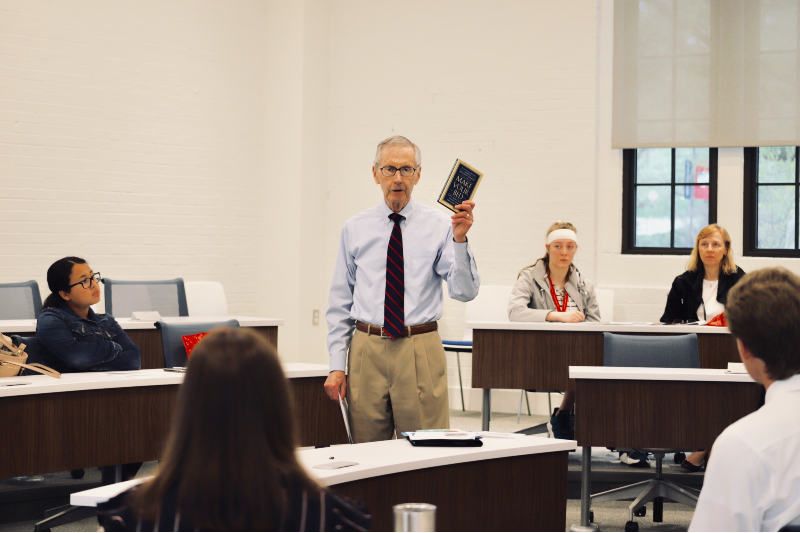

Our Accounting faculty, all certified CPAs, have considerable work experience in the public and private sectors, and they bring their work experience to the classroom. Each student will have a faculty mentor by their side for all four years, with small classes of 20 students for personalized attention.

What Makes Our Program Different

- All classes are taught by professors who have had decades of real-world business experience and every one of them is a CPA.

- Close mentoring of each Accounting major by such professors - their professor mentor remains the same for their four years at Catholic U.

- Upperclassmen student mentor (who is an Accounting major) for each incoming Freshman Accounting major.

- Small classes from the start- the first Accounting class is limited to 16 students. All other Accounting classes range from 5 to 20.

- With all professors having real-world experience, they are particularly good at advising students on their career search.

Jobs and Internships

For the past two years, 60% of Accounting students had a full-time job offer eight months before graduation. At graduation, 100% of them had full-time offers. Also, 50% of juniors have a summer internship eight months in advance of the summer.

Our graduates have offers from the Big Four prestigious global CPA firms- Deloitte, Ernest & Young (EY), KPMG, and PricewaterhouseCoopers (PwC), Graduates also take positions in local and regional firms.

-

Accounting Success Stories

Learn how recent Accounting graduates and alumni found success after graduation.

Learn More

Curriculum

Students majoring in accounting will complete the requirements below:

-

Major Requirements

Explore the accounting requirements and other courses you can take in the Busch School. -

Accounting Specialization

This specialization prepares graduates to identify, measure, analyze, interpret, and communicate financial information to managers so that good financial decisions can be made.

-

Academic and Professional Responsibilities

The primary aim of the Accounting Program is to prepare students academically and professionally for an initial career in the public accounting profession, and to earn the Certified Public Accountant (CPA) certificate.

As such, to remain as an Accounting major, or to transfer in to the Accounting major, a student must achieve the following:

Academically: (a) earn at least the grade of B in the first two accounting courses which are: ACCT 205 (Introductory Accounting) and ACCT 206 (Managerial Accounting); and (b) have and maintain a GPA of at least 3.00 through the end of their sophomore year.

Professionally: (a) attend promptly and prepare well for all classes, and any meetings with professors, mentors, and advisors; (b) participate in events required of accounting majors, and (c) always act ethically and with integrity in all on-campus and off-campus activities.

Students who have not achieved the above, will not be able to enter or continue in the Accounting Program and will be assisted by their faculty advisor to identify another plan of studies or major within the School of Business. -

Internships

Some 80% of Accounting major graduates go to work for a global, national, or regional CPA firm. They offer tremendous career and learning opportunities with high starting salaries in the range of $55,000 to $60,000. Such firms typically start their recruiting of Accounting majors in their sophomore or junior year, through two day “Externships” and eight week “Internships”. If a student performs well during the summer internship they can expect to be offered a full time position upon graduation and completion of 150 credits.

Read more about internship opportunities. -

Minor Programs

Students majoring in accounting have a wide variety of minors available to them and may choose from many disciplines offered across the University. Popular choices for accounting majors are: foreign languages, politics, or philosophy. Students majoring in accounting may also minor in a business discipline. See the options listed here.